Mortgage & Wealth Strategies

Say Hello To The Easiest Way To Mortgage

.png)

Beyond The Rate

As expert mortgage brokers, we know building wealth through homeownership and achieving financial freedom is about more than just chasing the lowest rate—it’s about strategy.

We're taking you behind the scenes and giving you the insider tools and powerful strategies to get ahead. If you’re a first-time homebuyer, you’ll find everything you need to secure your first property and start building wealth from day one.

If you’re an existing homeowner, this is where you take control. Maximize the wealth-building potential of your current home with proven strategies for refinancing, leveraging equity, and optimizing your mortgage for bigger opportunities.

Your mortgage is more than a loan—it’s a gateway to long-term financial success.

Our goal is simple: to equip you with the knowledge and tools to make smart, strategic decisions that will transform your financial future.

Let’s get started.

Unpacking the First Home Savings Account: Your Guide to First-Time Homebuying!

June 11, 2023 | Posted by: Matt Broom-Hall

Heads up, future homeowners! Ever fantasized about the smell of fresh paint in your very first home? With housing markets finding their footing and prices looking up, there's no better time to turn that dream into a reality! The cherry on top? Our Canadian government is lending a helping hand with the launch of the First Home Savings Account (FHSA). Exciting, right? Let's dive in!

The 101 on FHSA

Picture this: A registered plan where you can stash away up to $40,000 for your first home—tax-free! Kind of like a secret home-buying piggy bank. You can slide in up to $8,000 annually and deduct these contributions from your taxable income (just like an RRSP). Even better, any interest you accumulate is tax-free, and when you're ready to play house for real, your savings are available tax-free, just like a TFSA!

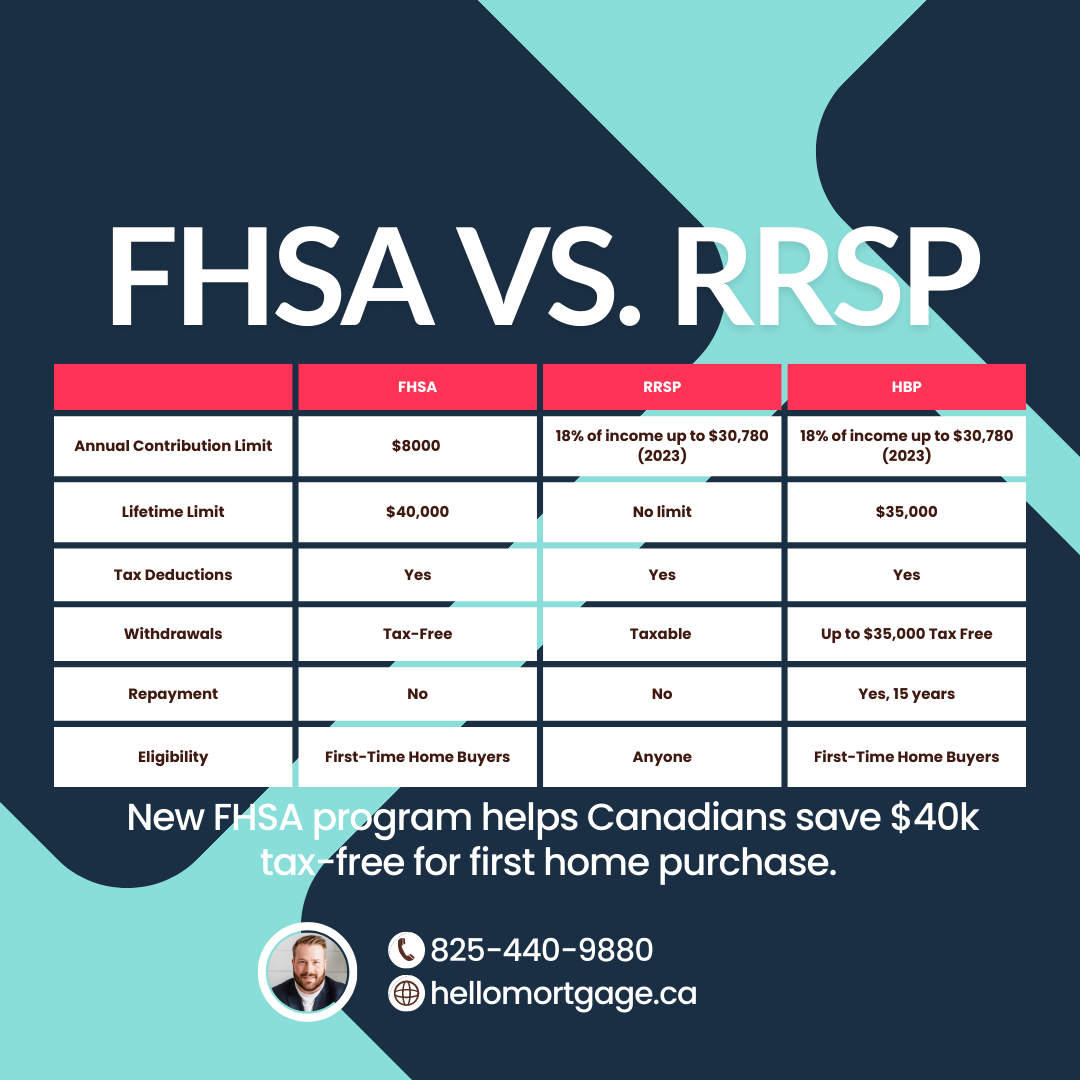

FHSA vs RRSP: The Faceoff

Now you might be thinking, 'Sounds a lot like my RRSP, right?' Well, yes and no. Both let you deduct contributions from your taxable income, but pull out money from the FHSA for your first home, and you won't pay a dime in taxes! With RRSPs, you'll have to deal with taxes on withdrawals (unless you use the HPB—but more on that soon). And while RRSPs give you unlimited savings potential, they do have an annual contribution limit of 18% of income or $30,780 (as of 2023). With the FHSA, you've got an annual limit of $8,000 and a lifetime cap of $40,000.

The Dynamic Duo: FHSA and HBP

Double down on savings by pairing your FHSA with the Home Buyers' Plan (HBP). The HBP lets you withdraw up to $35,000 from your RRSPs to buy or build a dreamy home, with repayments spread over 15 years. But here's the kicker—the FHSA doesn’t demand repayment! Use these power tools together, and you're looking at a hefty savings boost and trimmed down taxes!

Do You Qualify?

Before you start dreaming of paint swatches, let's check if you tick these boxes:

- You're a true-blue resident of Canada and 18 years or older.

- You've never owned a home, and neither has your spouse or common-law partner in the past four years.

- You've got a written agreement to buy or build a qualifying home for yourself or a related person with a disability.

- You're planning to live in the qualifying home as your primary residence within one year of purchase.

- Remember, additional conditions may apply!

Wrapping It Up!

If you're a newbie homebuyer eager to save for your very own corner in the world, the FHSA is your new best friend. It allows you to tuck away more funds than an RRSP and offers tax-free withdrawals. Throw in the HBP, and you're looking at a turbo-charged savings plan with major tax cuts!

Keep in mind, though, that the FHSA is just one of many tools in your first-time homebuyer's kit. It's essential to do your homework and chat with a financial advisor to figure out the savings strategy that suits you to a T! Happy home hunting!'

.png)