Mortgage & Wealth Strategies

Say Hello To The Easiest Way To Mortgage

.png)

Beyond The Rate

As expert mortgage brokers, we know building wealth through homeownership and achieving financial freedom is about more than just chasing the lowest rate—it’s about strategy.

We're taking you behind the scenes and giving you the insider tools and powerful strategies to get ahead. If you’re a first-time homebuyer, you’ll find everything you need to secure your first property and start building wealth from day one.

If you’re an existing homeowner, this is where you take control. Maximize the wealth-building potential of your current home with proven strategies for refinancing, leveraging equity, and optimizing your mortgage for bigger opportunities.

Your mortgage is more than a loan—it’s a gateway to long-term financial success.

Our goal is simple: to equip you with the knowledge and tools to make smart, strategic decisions that will transform your financial future.

Let’s get started.

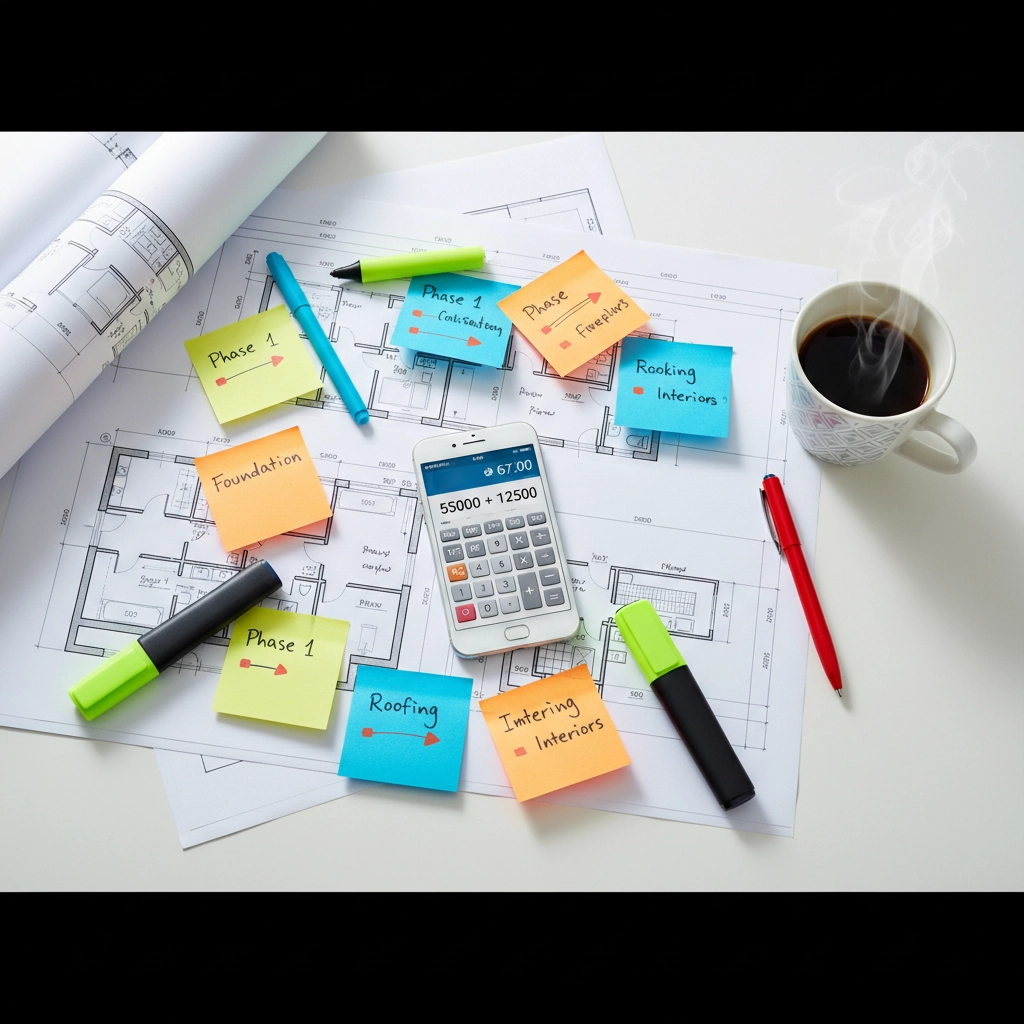

New Build & Construction Mortgages in Alberta: What Homebuyers Need to Know

November 5, 2025 | Posted by: Matt Broom-Hall

New Build & Construction Mortgages in Alberta: What Homebuyers Need to Know

Say Hello to Your Dream Home : Where Smart New Build Financing Makes Your Vision Reality.

Building a new home in Alberta is exciting, but navigating the mortgage landscape? That's where things can get a little overwhelming. Here's the thing: new build mortgages are fundamentally different from traditional home purchases, and understanding these differences upfront can save you thousands of dollars and months of headaches.

Whether you're eyeing a new development in Calgary, planning a custom build in Edmonton, or considering a production home in Red Deer, the financing strategy you choose will make or break your project timeline and budget.

The Two Types of New Build Mortgages: What's Right for You?

When it comes to financing your Alberta new build, you've got two main options, and choosing the wrong one can cost you big time.

Completion Mortgages: The Popular Choice

Completion mortgages are the go-to option for most Alberta homebuyers, especially if you're working with production builders on properties under $1 million. Here's how they work: you give your builder a deposit, and then the lender funds the remaining amount on the day you get your keys.

The beauty of completion mortgages? You're not paying mortgage payments during construction. You're simply waiting for your dream home to be finished while your money sits safely with the lender.

Draw Mortgages: For the Hands-On Builder

Draw mortgages work differently. After your deposit to the builder, your mortgage gets dispersed in stages throughout the build period. Think of it as your lender releasing funds as milestones are hit : foundation complete, framing done, drywall finished, and so on.

The catch? Your rate is locked in from day one because the money starts flowing immediately. No rate holds, no shopping around later : you're committing to your mortgage terms right from the start.

Rate Holds: Your Secret Weapon Against Market Volatility

Here's where completion mortgages really shine, and it's something every Alberta new build buyer needs to understand: we can hold your rate for up to 18 months.

But here's the exciting part : 120 days before you move into your new home, we start shopping around to make sure you're getting the very best rates and mortgage options available. It's like having insurance against rate increases while still being able to benefit if rates drop.

Pro tip from the trenches: If your builder is saying 9 months to completion, get a rate hold for at least 12 months. Alberta's construction market has seen its share of delays, and you don't want to be caught scrambling for financing when your builder calls to say they need another three months.

The Appraisal Reality Check

Let's clear something up right away : forget what you might have heard about getting appraisals done on blueprints and plans. Most lenders in Alberta want to see pictures of your completed property before finalizing your mortgage.

This means your appraisal typically happens closer to possession, when there's actually something to photograph and evaluate. It's just the reality of how Alberta lenders operate, and trying to rush this process usually backfires.

Where's Your Deposit Coming From? (And Why It Matters)

This is where many new build buyers trip up. Your deposit source needs to be crystal clear and well-documented. Here are your main options:

Savings: The straightforward route. If you've been saving for years, make sure you have clear paper trails showing where this money came from.

RRSP Withdrawals: Perfect for first-time buyers using the Home Buyers' Plan. You can pull up to $35,000 per person ($70,000 for couples) from your RRSPs.

Gifted Funds: Getting help from family? That's completely normal, but your lender will need a gift letter confirming this money doesn't need to be repaid.

Sale Proceeds: Already own a home? This brings us to our next crucial point...

No Liquid Cash for the Deposit? Here’s How to Unlock It

If your deposit is tied up in the equity of your current home, you’re not stuck. It’s about strategy—temporary access to equity, clever timing, or both. Here are the Alberta-proven options we line up for clients:

Bridge Financing: Use your existing home’s equity to cover the builder deposit, upgrades, and closing costs before you sell. Most lenders want a firm sale on your current home; once that’s in place, bridge funds cover the gap between your two closings. Expect a short term, interest-only cost and, yes, two payments for a brief period. The win: you don’t have to rush your sale.

Deposit Loan or Line of Credit: No firm sale yet? We can arrange a short-term deposit loan or LOC—unsecured for strong files, or secured against your home—to front the builder’s deposit. You make interest-only payments during the build and clear it from sale proceeds at possession. Already have a HELOC? That’s often the lowest-cost route.

Second Mortgage (Short-Term): When timelines are longer or the numbers are tight, a small, open second mortgage can unlock the deposit without touching your first mortgage. Slightly higher cost, big flexibility.

Time the Sale to Release Funds: Sequence your sale to close before a major deposit milestone or before possession. Pair this with a rent-back or short-term rental and your deposit comes cleanly from net proceeds.

Negotiate the Deposit Schedule: Many Alberta builders will split deposits into stages or accept a lower initial amount if you’re pre-approved and have a clear equity plan. We’ll help you script that conversation so everyone has confidence in the timeline.

How Hello Mortgage helps: we map your equity, run a clear bridge/loan vs. timing cost comparison, and coordinate the plan with your builder, realtor, lender, and lawyer. We lock a long rate hold, monitor with RateWatch+, and re-negotiate 120 days before possession so you keep the upside if rates drop.

Already Own a Home? Here's Your Game Plan

If you're building while you already own, timing becomes everything. You've essentially got three strategies to choose from:

Strategy 1: Bridge Financing

This lets you access your home equity to fund your new build deposit and costs while keeping your current home. You'll have two mortgage payments temporarily, but it gives you flexibility on timing your sale.

Strategy 2: Sell First, Rent Back

Sell your current home but negotiate a rental agreement with the buyers until your new build is ready. This eliminates carrying costs but requires finding cooperative buyers.

Strategy 3: Time It Perfectly

The high-wire act : listing your home to close exactly when your new build is ready. Risky, but it can work beautifully with the right coordination.

Each strategy has trade-offs, and the right choice depends on your local market conditions, risk tolerance, and how confident you are in your builder's timeline.

Communication is Everything: Stay Connected Throughout the Build

Here's something that catches too many Alberta new build buyers off guard: every time you add an upgrade, every contract change, every revised completion date needs to be communicated to your mortgage broker immediately.

Adding $50,000 in upgrades? We need to know. Pushing back your possession date by two months? Critical information. Switching from laminate to hardwood throughout? That affects your mortgage approval.

Why does this matter so much? Because your mortgage approval is based on specific purchase details, timelines, and property values. Change any of these variables without keeping your broker in the loop, and you risk having your financing fall apart at the worst possible moment.

The smart move? Touch base with your mortgage broker every 2-3 months during the build process. It takes five minutes and could save your entire transaction.

Beyond the Basics: What Makes Alberta Different

Building in Alberta comes with its own unique considerations. Our seasonal construction patterns mean winter builds can face delays. Our resource-driven economy affects both construction costs and lending appetite. And our diverse geography : from urban Calgary to rural acreages : means different lenders have different comfort levels with different projects.

The bottom line? Cookie-cutter mortgage advice from national websites doesn't cut it when you're building in Alberta. You need local expertise that understands both the market and the lenders.

Making the Right Choice for Your Situation

Every new build situation is unique, but here are the key questions that will guide your decision:

- Are you working with a production builder or going custom?

- Is your purchase price under or over $1 million?

- How hands-on do you want to be with the construction process?

- Do you currently own a home that needs to be sold?

- How comfortable are you with interest rate risk?

The answers to these questions will determine whether a completion mortgage or draw mortgage makes more sense, how long your rate hold should be, and what kind of timeline coordination you'll need.

Your Next Steps: Making New Build Dreams Reality

Building a new home in Alberta doesn't have to be overwhelming. With the right financing strategy and expert guidance, you can navigate the process confidently and secure the best possible mortgage terms.

Remember: the mortgage market is constantly evolving, builder timelines shift, and what worked for your neighbor might not be the best strategy for your situation.

Ready to explore your new build financing options? Connect with our team : we'll walk you through the process, explain all your options, and make sure you're set up for success from foundation to keys in hand.

After all, building your dream home should be exciting, not stressful. Let us handle the mortgage complexity so you can focus on picking out paint colors and planning your housewarming party.