Mortgage & Wealth Strategies

Say Hello To The Easiest Way To Mortgage

.png)

Beyond The Rate

As expert mortgage brokers, we know building wealth through homeownership and achieving financial freedom is about more than just chasing the lowest rate—it’s about strategy.

We're taking you behind the scenes and giving you the insider tools and powerful strategies to get ahead. If you’re a first-time homebuyer, you’ll find everything you need to secure your first property and start building wealth from day one.

If you’re an existing homeowner, this is where you take control. Maximize the wealth-building potential of your current home with proven strategies for refinancing, leveraging equity, and optimizing your mortgage for bigger opportunities.

Your mortgage is more than a loan—it’s a gateway to long-term financial success.

Our goal is simple: to equip you with the knowledge and tools to make smart, strategic decisions that will transform your financial future.

Let’s get started.

Is Your Alberta Mortgage Tax-Deductible? (Part 2): Is This Strategy Right for You?

February 2, 2026 | Posted by: Matt Broom-Hall

Is Your Alberta Mortgage Tax-Deductible? (Part 2): Is This Strategy Right for You?

![[HERO] Is Your Alberta Mortgage Tax-Deductible? (Part 2): Is This Strategy Right for You?](https://cdn.marblism.com/gPRIqO8mYSI.webp)

Welcome back! In Part One, we covered the basics of how to make your mortgage interest tax-deductible in Alberta, and yes, it's 100% legal. We walked through The Clean Slate, The Swap, and The Smith Manoeuvre. Now comes the real question: Is this strategy actually right for you?

Because here's the thing: just because you can do something doesn't always mean you should. This isn't a one-size-fits-all move. It requires the right setup, the right mindset, and honestly, a bit of patience. But for the right Alberta homeowner? It can be a total game-changer.

Let's dig into who this works for, how to think about the math, and answer the top five questions I get asked every single time this topic comes up.

Who Can Actually Play This Game?

In theory, any Alberta homeowner with a mortgage could pursue a tax-deductible mortgage strategy. But in reality, there's a key gatekeeper: equity.

Here's the deal: if you want to use the Smith Manoeuvre (the most popular version of this strategy for people without a pile of investments sitting around), you'll need a readvanceable HELOC that grows as you pay down your mortgage. And to qualify for one of those? You need at least 20% equity in your home.

Why? Because lenders won't let you borrow more than 80% of your home's value. So if you're sitting at 95% loan-to-value with a high-ratio mortgage and CMHC insurance, you'll need to keep chipping away at that principal until you hit the 20% equity threshold. Once you're there, you can unlock a readvanceable product and start converting your debt.

If you're not at 20% yet, don't stress. Focus on paying down your mortgage aggressively for now. The strategy will still be there when you're ready.

What About Folks With Investments Already?

Now, if you're sitting on a non-registered investment portfolio and you have a mortgage, you're in the driver's seat. You can execute 'The Swap' we talked about in Part One, sell your investments, pay off the mortgage, reborrow the same amount, and repurchase your investments 30 days later (to stay onside with CRA rules). Everything stays the same, except now your interest is tax-deductible.

If you're in this camp and you haven't made the move yet, my blunt take? What are you waiting for?

The 'Should I?' Math: Does This Actually Make Sense?

Okay, so you've got the equity. Now let's talk numbers.

The key question you need to answer is this: Can I invest the reborrowed money in something that earns more than the after-tax cost of my HELOC interest?

Here's an example to make it real.

Let's say:

- Your HELOC interest rate is 5%

- Your marginal tax rate is 40% (pretty common for Alberta professionals earning $100K+)

Because the interest is tax-deductible, your effective interest cost is only 3% (that's 5% minus the 40% tax savings).

So now the question becomes: can you invest in CRA-eligible assets (think dividend-paying stocks, REITs, bonds, etc.) that will earn you more than 3%? If the answer is yes, you're ahead of the game.

But Wait, There's More to Consider

Keep in mind that your investment returns will also be taxed. Dividends, interest, and capital gains all come with tax implications, so you'll want to factor those in too. This is exactly why I always recommend partnering with a top-tier financial planner before pulling the trigger on this strategy. They'll help you pick the right investments and run the real numbers based on your situation.

The Secret Sauce: Compounding, Time, and Leverage

Here's where this strategy really starts to shine, and it's not just about the tax deduction.

Most Canadians follow the traditional path: pay off the mortgage first, then start building an investment portfolio. But here's the problem with that approach: it costs you time. And time is the single most powerful ingredient in wealth-building.

Why? Compounding.

Compounding means that your investment returns start generating their own returns. The longer you let that process run, the more exponential the impact. Starting to invest now, even while you still have a mortgage, gives you years (or decades) of extra compounding compared to waiting until your mortgage is paid off.

Fraser Smith, the financial planner who pioneered the Smith Manoeuvre, put it this way: 'Two-thirds of the benefit comes from owning your investments now instead of later. About one-third of the benefit is the effect of converting to tax-deductible interest.'

Let that sink in. The tax savings are great, but the real magic is getting your money into the market sooner.

Leverage: Your Home Is Already Working For You

Think about it: most retirees today built wealth through their home, which appreciated over decades. That's leverage in action. You put down 20%, and the bank lends you the other 80%. The whole property goes up in value, but you only had to come up with a fraction of the purchase price.

What this strategy does is let you take that same leverage and redirect it. Instead of all your equity sitting locked up in your house, you're diversifying it into a portfolio, while still owning the home and making the interest tax-deductible.

Top 5 Burning Questions (Answered)

Alright, let's tackle the most common concerns I hear from Alberta homeowners considering this strategy.

1. Isn't This Risky? Am I Taking On More Debt?

Not necessarily. If you're using the basic Smith Manoeuvre, you're not increasing your overall debt load. You're simply shifting where your equity sits: from your house into a diversified investment portfolio.

The 'risk' is that you're converting home equity into investment equity. That's a personal decision. Some people sleep better at night knowing their equity is tied up in bricks and mortar. Others would rather have it working harder in the market.

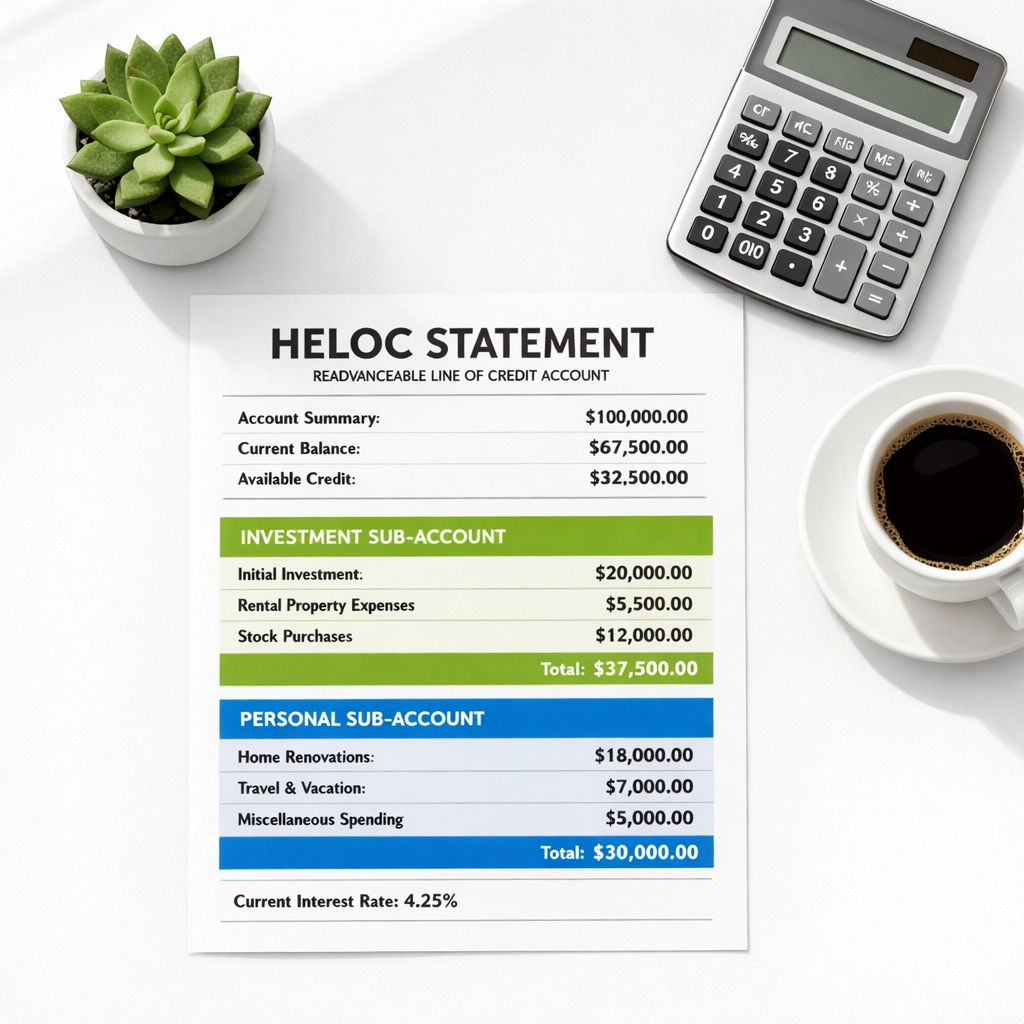

2. Are All HELOCs the Same?

Nope. And this is huge.

Some HELOCs give you one big account. Others let you split your borrowing into sub-accounts. You want the sub-account version. Why? Because it makes tracking your tax-deductible interest way easier. You keep your investment borrowing in one sub-account and any other personal borrowing (like a reno or vacation) in another. When tax season rolls around, everything is crystal clear for the CRA.

Also, rates vary. Some lenders offer HELOCs at prime + 0.5%, while others might charge prime + 1% or more. That's where shopping around pays off: and where working with a broker like us gives you access to 50+ lenders instead of just one.

3. Should I Sell My RRSPs to Do This?

Hard no.

Your RRSP is a tax-sheltered account where your money compounds tax-free. Once you pull money out, you can never put it back in. Plus, withdrawals count as income and get taxed. Leave your RRSP alone. This strategy works best with non-registered investments or by gradually building a portfolio using your Smith Manoeuvre reborrowings.

4. What About Today's Interest Rates?

Great question. With rates lower than they've been in years, your tax savings from deductibility are smaller than they'd be in a higher-rate environment. But remember Fraser Smith's point: most of the benefit comes from getting invested sooner, not just from the tax break.

For context, if you're converting a variable mortgage at prime - 0.60% (around 2.4%) to a HELOC at prime + 0.50% (around 3.5%), your after-tax cost in a 40% tax bracket is only 2.1%. That's still cheaper than your original mortgage: and the benefit grows as rates rise.

5. Does This Mess With My Principal Residence Capital Gains Exemption?

Nope. Not at all.

Your home is still your home. The fact that you've borrowed against it to invest elsewhere doesn't change the fact that it's your principal residence. When you sell, you're still entitled to the capital gains exemption. This is a common fear, but it's completely unfounded.

So… Is This Strategy Right for You?

Here's my take.

This strategy works best if:

- You have at least 20% equity in your Alberta home

- You're comfortable with the idea of diversifying your equity into investments

- You have a long time horizon (think 10+ years)

- You're willing to work with a financial planner to pick the right investments

- You want to build wealth faster instead of waiting until your mortgage is paid off

If that sounds like you, it's worth exploring. And if you're not sure whether your current mortgage setup allows for a readvanceable HELOC with sub-accounts, that's where we come in.

At Hello Mortgage, we work with 50+ lenders across Alberta. That means we can shop around to find you the best HELOC product with the features you need: and the rate you deserve. We'll walk you through the whole process, answer your questions, and connect you with a financial planner if you need one.

Ready to see if this strategy fits your situation? Reach out to us and let's talk. We'll take a look at your current setup, run the numbers, and help you make the smartest move for your financial future.

Because at the end of the day, it's not just about rates. It's about strategy.

Empowering You. Elevating Communities. Redefining The Mortgage Journey.